Youth programming is the ‘heartbeat’ of the organization’s work.

Southside Community Center aims to do more than bring people together but also to collect meaningful information that holds value in bettering the community.

On a weekly basis for 6-8 weeks, a few people from the center partake in a program called Financial Freedom Collective. The collective was designed to face the displacement and the obstacles that numerous Women of Color face, especially single Black mothers.

Normalizing Black Girlhood

As a historically black center, The Southside Community Center is a public resource bearing political, recreational, and educational assets to empower African-American citizens of Ithaca.

Southside Community Center was incorporated in 1934 by a group of Black women called the Francis Harper Women club; a space focused on sharing beliefs on inequality and interracial civil rights.

The Center acted as one of the only places where Black people could go for basic resources and serves a similar purpose today.

Dr. Nia Nunn, born and raised in The Southside Community Center, now works as board president. “It’s quite transformative . . . that was significant in my childhood,” she said.

Nunn talks about how valuable it can be to have a space to be unapologetically Black when you have been confined by predominantly white spaces.

There are 30 kids in the kindergarten through the fifth-grade program while roughly 20 preteens and teenagers visit daily. “Youth programming is my heartbeat of the work,” Nunn said.

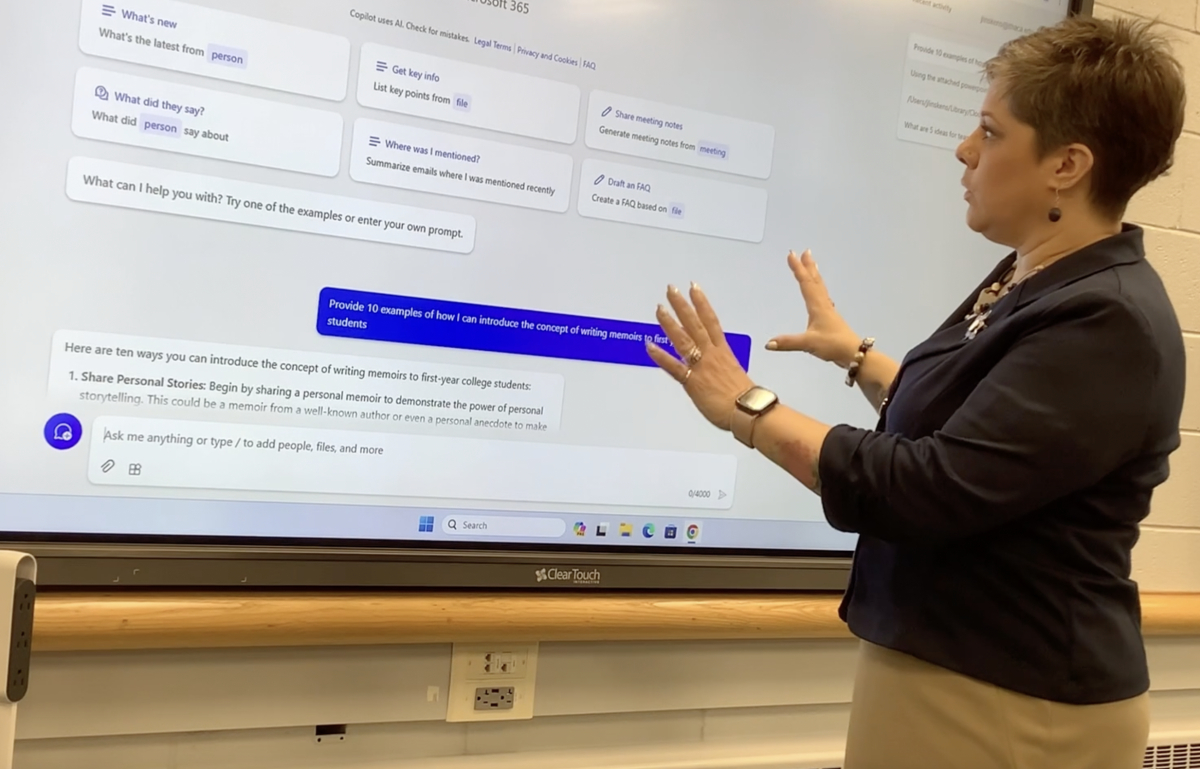

Confronting the financial racial divide

Black women are encouraged and empowered to access educational and financial resources that provide full financial support. For a few hours, people will engage in conversation about savings, debt, and credit and set goals.

Daraisi Marte is the Program Director at Southside Community Center and is currently trying to find a house.

Marte benefits from Financial Freedom Collective by learning how to budget, taking classes on how to find a home, and how refinance cars.

“A major contribution to the collective is the willingness to be vulnerable,” Nunn said.

Nunn talks about how the design of curriculum in schools and what we are taught through childhood prevents us from addressing these societal realities and keeps hierarchies alive.

The work in this program is about recognizing the visibility in these deeply rooted systems along with the journey and the resources available.

Resana Malone is another participant who appreciates her honesty and vulnerability in striving to save money.

“I am able to talk it out with people that aren’t judgemental and will give me different solutions in baby steps to help me get comfortable with finances,” Malone explained.

Malone emphasized the lack of educational programming in schools that teach people about finances.

This program teaches individuals how to confront these issues that they may shy away from.

Stronger Together

The Financial Freedom Collective aims to surface beyond personal relationships and reach the community on a larger scale. Participants work to encourage people to reflect on their financial freedom. Nunn points out the reality in Ithaca that many refer to as a poverty pump.

The poverty pump is a transparent and substantive system that places people in the statute of poverty and insures they will stay there.

The Southside Community Center challenges that social construction. The Women of Color within the Financial Freedom Collective share a common goal; to uncover the inequity surrounding economics and finances.

“For the most part, it has been a collective of black women that want to break those generational curses,” Malone said.

Malone said the fact that being able to share a space with black people and discuss an issue that is rarely touched upon is empowering.

Some of the resources that are shared during these engaging conversations are about more than money. Nunn discussed how she integrates the exercises from the books she reads into the classes.

Recently, she read a book by Rachel Rogers titled “We Should all be Millionaires” where she analyzed million-dollar values, boundaries, and decisions.

The book is less focused on finances and more on navigating time and health. “The last couple sessions we ended up talking about our early morning rituals and dynamics of relationships,” Nunn said.

In these conversations, people start to realize that being able to openly discuss life work is a foundation for obtaining financial freedom.

“It is powerful . . . the relationships that have been formed by tuning into your own world but in the space of others who are navigating their financial world,” Nunn said.

https://youtu.be/zXlg7BD9ZwU